· Recently, the Federal Reserve Board released data indicating that the sharpest monthly drop, since data began to be collected, occurred in consumer credit during July 2009.

· In February, year-to-year consumer credit card debt began to decrease for the first time in forty years.

· Consumer Reports indicated that fully 32% of credit cardholders have paid off and closed a credit card account, since January of 2008.

One can only hope that these data indicate an decrease in consumer indebtedness and a change in the saving/borrowing habits of the American consumer. On the other hand, it could simply be a price effect following from changes in the policies of credit card issuers. We’ll focus on these changes and what you can do about them, next week. For now, however, let’s try to be positive, while we look at some facts.

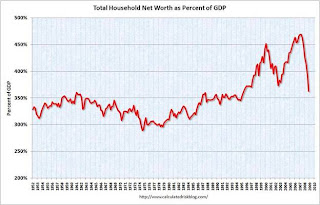

The credit picture for the United States has not been pretty, as one can see in the chart below. It is clear that this decade could easily be called the decade of binge-debt. This has occurred for two reasons: consumer debt has increased and the net worth of households’ has decreased. We’ve been borrowing to protect, perhaps increase, our consumption.

The good news, however, is that the trend appears to be turning the corner, in the midst of appeals for “stimulation” by our leadership. I must admit that while the country needs us to stimulate the economy, by adding demand to increase employment, those of us with jobs and the ability to improve our personal balance sheets are doing just that – controlling what we can control. (The last time I looked, the only thing I can control is myself and I admit that I, too, can wonder about my effectiveness at exerting that control.) At the national level, however, the chart below shows the trend in household net worth as a percentage of the Gross Domestic Product over “my” lifetime. I believe that this is the primary impetus for our national reaction of decreasing our exposure to liabilities and to begin to add to our assets. To say the last ten years have been volatile would be like saying the H1N1 flu is a runny nose. The rapid, steep increases, beginning in the late 1990s, have been followed by two precipitous drops. As you can see, these are unprecedented in post-WWII America. It is enough to make the most hardened consumer/investor take notice. And they have.

What have they noticed.

· They are not saving enough.

· They are borrowing way more than they can comfortably repay, under several accepted measures of consumer indebtedness.

· Their assumptions on returns used in their financial plan, assuming they have a financial plan, were much too optimistic.

· Some of their goals have turned into wishes, while some of their wishes have turned toward cold realities.

· Job security is a primary issue and, for some of my friends, they have found that it is not easy to get a new job if you are a baby boomer. The same is true for several recent college graduates to whom I’ve spoken.

Yet, Americans are survivors, explorers, and innovators. They can make adjustments and continue to be the most productive workforce in the world. Americans have always been this way and we will continue to try to lead. As an example, we’ve begun to increase our savings rate, as indicated in the chart below. You will notice that increases in the savings rate generally appear during recessions (the blue bars) and, this time, we’ve a long way to go, in order to reach the saving rates of thirty years ago. I cannot say with certainty that we’ll get there. I fully expect, however, that we will try.

Financial success demands that we continue to move in the direction we’ve begun to head. When we save, we not only protect our futures, our children’s future, and our grandchildren’s future; but the monies are productively employed by our economic system to make new capital investments in plants and equipment, thus continuing to increase our productivity. The best source of economic growth available.

After I wrote the above and I was leaving home this morning (Thursday), CNBC reported the following:

The U.S. economy grew in the third quarter for the first time in a year as consumer spending and investment in new home-building rebounded, data showed on Thursday, unofficially ending the worst recession in 70 years.

While this is great news, do not tell your “spending ego” that the recession is over and we can return to our consumption frenzy. Keep your money directed toward your goals and your productivity directed at the solution.